In 2013, the iron and steel industry is expected to see a modest improvement in profitability, driven primarily by higher production capacity utilization and increased inventory restocking during peak seasons. While overcapacity remains a challenge, the performance of iron ore suppliers is likely to outpace that of steel producers due to tighter supply conditions.

Capacity utilization is projected to rise slightly in 2013, as new capacity growth slows down more rapidly than demand expansion. We estimate that actual steel consumption will reach 715 million tons, with crude steel output reaching around 744 million tons if we exclude inventory adjustments. However, considering the restocking activity following the inventory drawdown in 2012, total crude steel production could climb to 754 million tons. This would result in a 1-2% increase in capacity utilization compared to 2012. If restocking occurs during the traditional spring and autumn peak seasons, capacity utilization during those periods could jump by 3.1% to 6.7%, potentially reaching as high as 82.5%.

Looking at iron ore prices, a rebound is expected from late 2012, and this recovery may be stronger than that of steel prices. As steel production utilization improves, it could push steel prices higher than the levels seen in the fourth quarter of 2012. The seasonal restocking period is likely to create short-term price spikes. Currently, iron ore inventories at steel mills are low, but with inventory levels expected to recover, there may be a 4% increase in restocking demand. Crude steel output is anticipated to grow by 5-6%, while overall demand is projected to rise by about 10% for the year. Additionally, major mines have limited capacity to increase supply, leading to a potential small supply gap in 2013. For now, iron ore producers still hold a stronger position relative to steel companies.

Overall, the profitability of the iron and steel sector is expected to improve, though overcapacity will continue to limit gains. Profitability is likely to be concentrated during the peak season when restocking activities boost demand. However, steel prices will face constraints due to excess capacity. On the other hand, iron ore producers are in a better position and are expected to benefit significantly in 2013.

In 2013, the iron and steel industry is expected to see a modest improvement in profitability, driven primarily by higher production capacity utilization and increased inventory restocking during peak seasons. While overcapacity remains a challenge, the performance of iron ore suppliers is likely to outpace that of steel producers due to tighter supply conditions.

Capacity utilization is projected to rise slightly in 2013, as new capacity growth slows down more rapidly than demand expansion. We estimate that actual steel consumption will reach 715 million tons, with crude steel output reaching around 744 million tons if we exclude inventory adjustments. However, considering the restocking activity following the inventory drawdown in 2012, total crude steel production could climb to 754 million tons. This would result in a 1-2% increase in capacity utilization compared to 2012. If restocking occurs during the traditional spring and autumn peak seasons, capacity utilization during those periods could jump by 3.1% to 6.7%, potentially reaching as high as 82.5%.

Looking at iron ore prices, a rebound is expected from late 2012, and this recovery may be stronger than that of steel prices. As steel production utilization improves, it could push steel prices higher than the levels seen in the fourth quarter of 2012. The seasonal restocking period is likely to create short-term price spikes. Currently, iron ore inventories at steel mills are low, but with inventory levels expected to recover, there may be a 4% increase in restocking demand. Crude steel output is anticipated to grow by 5-6%, while overall demand is projected to rise by about 10% for the year. Additionally, major mines have limited capacity to increase supply, leading to a potential small supply gap in 2013. For now, iron ore producers still hold a stronger position relative to steel companies.

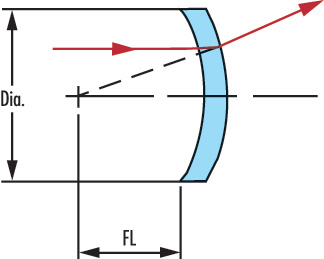

Overall, the profitability of the iron and steel sector is expected to improve, though overcapacity will continue to limit gains. Profitability is likely to be concentrated during the peak season when restocking activities boost demand. However, steel prices will face constraints due to excess capacity. On the other hand, iron ore producers are in a better position and are expected to benefit significantly in 2013.Meniscus cylinder Lens can increase the NA of the system while only adding slightly to the total spherical aberrations. The Negative Meniscus cylinder Lens is used to increase the focal length of another Cylindrical Lens while maintaining the angular resolution of the optical assembly. This lens shape is best used when one conjugate is relatively far from the cylindrical lens.

Some styles of cylindrical lenses have antireflective coatings to increase the transmission of light through the lens.

Fused silica cylinder lenses are ideal for demanding laser machining and medical applications.

Negative Meniscus cylinder lens   Â

Â

Â

Positive Meniscus cylinder Lens

Â

Specification of our meniscus cylinder lens or Plano-Convex Cylindrical Lens as follow:

*Material: BK7,Ge,UV-grade fuse silica(JGS1,JGS2,JGS3)or other optical materials

*Dimension Tolerance: +0.0 -- -0.1mm

*Center Thickness: +/-0.1mm

*Focal Length Tolerance: +/-1%

*Surface Quality:20/10

*Surface Figure: lambda/2 at 633nm on plano side

*Clear Aperture>90%

*Chamfer: 0.25mm at 45 degree typical

*Coating Optional

Meniscus Cylinder Lens,Optical Glass Meniscus Cylinder Lens,Meniscus Spheric Lens,Meniscus Cylindrical Lens

China Star Optics Technology Co.,Ltd. , https://www.csoptlens.com