In 2013, the iron and steel industry is expected to see an improvement in profitability, driven primarily by higher production capacity utilization and increased inventory restocking during peak seasons. While overall demand growth slowed due to reduced investment, the decline in new capacity expansion is anticipated to boost utilization rates. This shift could lead to a more balanced market and better margins for certain segments of the industry.

The actual steel consumption in 2013 is projected to reach 715 million tons, with crude steel output expected to hit 744 million tons without considering restocking. However, when factoring in the restocking efforts by steel traders, total output may rise to 754 million tons. This would result in a 1-2% increase in capacity utilization compared to 2012. During peak seasons—particularly spring and autumn—the utilization rate could jump as high as 82.5%, with potential increases ranging from 3.1% to 6.7%.

Looking at the iron ore market, prices are expected to rebound from late 2012, potentially rising more sharply than steel prices. As capacity utilization improves, steel prices could continue their upward trend from the fourth quarter of 2012. The restocking cycle during peak seasons may create short-term price spikes. Currently, iron ore inventories at steel mills are low, but they are expected to recover slightly in 2013, leading to a 4% increase in restocking demand. Crude steel production is forecasted to grow by 5-6%, while overall demand is expected to rise by around 10%. Meanwhile, major mines have limited supply growth, creating a small supply gap that could support higher prices.

The average price of 63% CIF iron ore is expected to reach $130 per ton in 2013. Although the overall industry profit level is expected to improve, overcapacity remains a key constraint, particularly for steel smelting. Iron ore companies, on the other hand, are likely to benefit more due to their stronger bargaining power relative to steel producers. Profits are expected to concentrate during peak season months, but the long-term outlook still hinges on managing excess capacity and maintaining stable input costs.

In 2013, the iron and steel industry is expected to see an improvement in profitability, driven primarily by higher production capacity utilization and increased inventory restocking during peak seasons. While overall demand growth slowed due to reduced investment, the decline in new capacity expansion is anticipated to boost utilization rates. This shift could lead to a more balanced market and better margins for certain segments of the industry.

The actual steel consumption in 2013 is projected to reach 715 million tons, with crude steel output expected to hit 744 million tons without considering restocking. However, when factoring in the restocking efforts by steel traders, total output may rise to 754 million tons. This would result in a 1-2% increase in capacity utilization compared to 2012. During peak seasons—particularly spring and autumn—the utilization rate could jump as high as 82.5%, with potential increases ranging from 3.1% to 6.7%.

Looking at the iron ore market, prices are expected to rebound from late 2012, potentially rising more sharply than steel prices. As capacity utilization improves, steel prices could continue their upward trend from the fourth quarter of 2012. The restocking cycle during peak seasons may create short-term price spikes. Currently, iron ore inventories at steel mills are low, but they are expected to recover slightly in 2013, leading to a 4% increase in restocking demand. Crude steel production is forecasted to grow by 5-6%, while overall demand is expected to rise by around 10%. Meanwhile, major mines have limited supply growth, creating a small supply gap that could support higher prices.

The average price of 63% CIF iron ore is expected to reach $130 per ton in 2013. Although the overall industry profit level is expected to improve, overcapacity remains a key constraint, particularly for steel smelting. Iron ore companies, on the other hand, are likely to benefit more due to their stronger bargaining power relative to steel producers. Profits are expected to concentrate during peak season months, but the long-term outlook still hinges on managing excess capacity and maintaining stable input costs.Germanium Plano-Convex (PCX) Lenses feature precision diamond turned surfaces making them ideal for a variety of infrared applications, including thermal imaging, infrared spectroscopy, and remote sensing. Germanium (Ge) is popular for its high index of refraction, broad transmission range, and rugged mechanical properties. These lenses are available in 25 and 50mm diameters, uncoated, or with multiple broadband coating options.

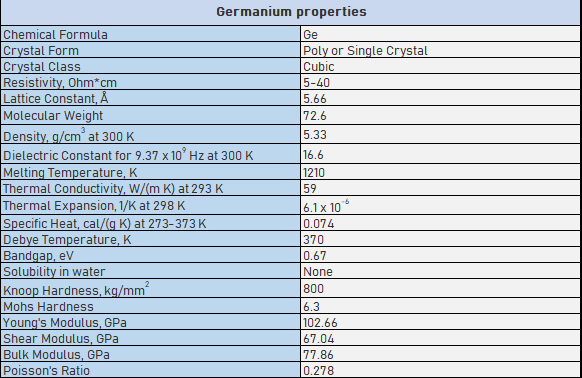

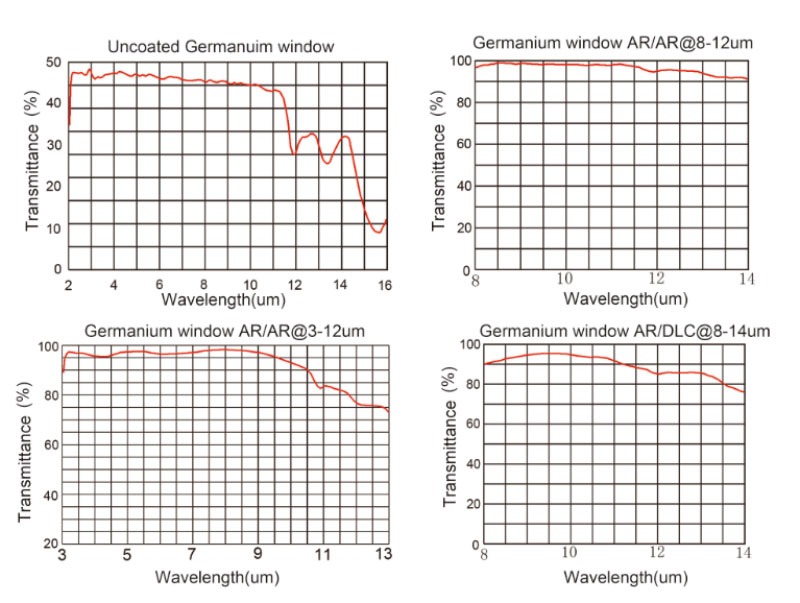

Germanium (Ge) material feature high index of refraction (around 4.0 from 2 - 14μm), an anti-reflection coating is recommended on these germanium windows for sufficient transmission in the region of interest. Germanium is subject to thermal runaway, meaning that the transmission decreases as temperature increases. As such, these germanium windows should be used at temperatures below 100°C. Germanium`s high density (5.33 g/cm3) should be considered when designing for weight-sensitive systems.

|

Germanium windows specifications |

||

| Â | Standard precision | High-precision |

| Dimension Tolerance | φ5-250mm+0/-0.2 | φ3-350mm+0/-0.2 |

| Thickness Tolerance | 1-50mm+/-0.1 | 1-50mm |

| Parallelism | 1 arc minute | 10 arc seconds |

| Surface Quality | 60/40 | 20/10 |

| Flatness | N<λ/2@633nm(at 50mm) | N<λ/10@633nm(at 50mm) |

| Clear Aperture | >90% | >95% |

| Chamfer | Protected <0.5mmx45deg | Protected <0.5mmx45deg |

Â

Germanium Lens,Ge Infrared Aspheric Lens,Germanium Aspheric Lens,Germanium Infrared Lens

China Star Optics Technology Co.,Ltd. , https://www.csoptlens.com